First, let's get an understanding of what a chargeback is and some typical reasons why one might occur.

What is a Chargeback?

A Chargeback (aka dispute) is a return of funds to the customer (similar to a refund). A chargeback is initiated by the issuing bank (cardholder's bank) once the customer informs it of an issue with a transaction.

Typical chargeback reasons:

The Cardholder...

-

did not authorize the transaction (fraud)

-

does not recognize the transaction

-

did not receive the purchased product/service

-

received an incorrect product or an unsatisfactory service

-

did not get a promised refund

-

was charged multiple times for the transaction

Sometimes chargebacks are initiated by the issuing bank itself for technical reasons, like:

Common Chargeback Questions:

What is the Chargeback process?

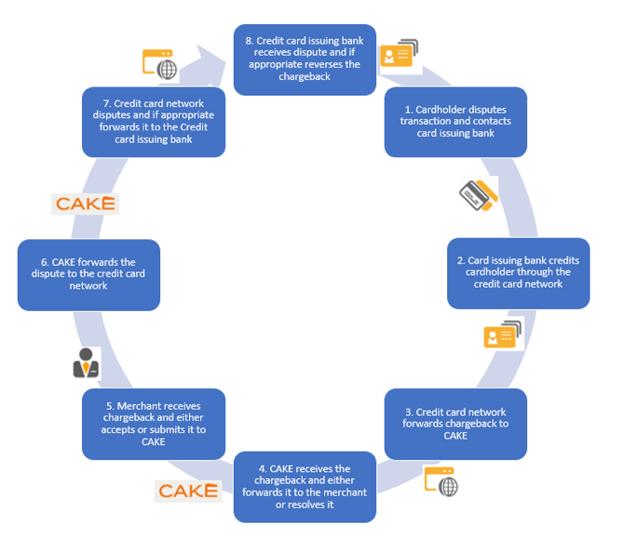

The below diagram visualizes the timeline and steps of a transaction made subject to a chargeback:

1. Cardholder disputes transaction and contacts card issuing bank

2. Card issuing bank credits cardholder through the applicable credit card network (e.g., Mastercard, Visa, Discover or AMEX)

3. Credit card network forwards chargeback to CAKE’s banking partners

4. CAKE receives the chargeback and forwards it to the operator

5. Operator receives chargeback and either accepts or disputes by submitting evidence of the validity of the transaction to CAKE

6. CAKE forwards the dispute to its banking partners and the credit card network

7. Credit card network if appropriate forwards it to the credit card issuing bank

8. Credit card issuing bank receives dispute and if appropriate reverses the chargeback

How will I be notified when a payment made at my restaurant was charged back?

You will be notified via email by CAKE (or its banking partners) when a chargeback has been made by the card issuing bank.

How much will a chargeback cost me?

Upon receipt of a chargeback for your restaurant, CAKE will automatically debit your bank account for the chargeback amount + the non-refundable chargeback fee of $20.00. In case you choose to dispute the chargeback and win the case, the chargeback amount will be returned to your bank account.

Where can I see the debit to my CAKE Payments account for a chargeback?

You will see the debit for the chargeback along with the non-refundable $20 fee in the “Account Balance” report in your Payments Report.

How do I respond to a chargeback?

You may respond to a chargeback by clicking on the “Dispute” button in your chargeback notification email. Clicking on this button will open a web page in the default web browser set on your computer where you will be able to provide details of the dispute and upload any supporting documentation.

How much time do I have to respond to a chargeback?

To contest a chargeback, provide your response within 7 days of the chargeback notice date. Beyond this period CAKE cannot guarantee that the card-issuing bank will review or reverse the dispute within card network timeframes. It’s best to follow the dates on the chargeback notices to ensure you have enough time to respond.

Is a response to a chargeback required?

If you receive an invalid chargeback, CAKE recommends that you reply as soon as possible. If you identify that the chargeback received is valid, meaning that the cardholder has a legitimate reason to chargeback, do not dispute the chargeback. The customer will be automatically refunded.

What happens if I don’t respond?

If no response is submitted within the allotted times permitted for a dispute response, by default the chargeback is deemed accepted and the debit for the chargeback will be permanent.

What kind of information shall I provide to fight a chargeback?

A chargeback notification from CAKE (via email) will describe the type of evidence you need to provide to contest the chargeback. Typically, this proof is a legible, signed copy of the receipt and any comments that will explain what happened during the transaction.

Is CAKE involved in the chargeback decision?

CAKE is not involved in the chargeback decision. CAKE forwards the evidence submitted to the issuing bank and card network who are responsible for the final decision.

How long will it take for me to know the result of the chargeback?

Response times from the card-issuing banks and the applicable card network vary.

When will I know if I won the chargeback or lost it?

CAKE will notify you via email if a chargeback received was lost or won. Please track the chargeback emails for more resolution information. Note that the faster you reply to the initial chargeback notice the quicker the response can be expected from the card-issuing bank.

Which email address will I receive chargeback notifications to?

Chargeback emails will be sent to the restaurant’s billing email address that was provided to CAKE during onboarding. Contact CAKE Support to update the restaurant's billing email address.

How can I check the status of a chargeback?

Select the ‘Dispute’ button in the chargeback notification email. This will open the application you used to submit the dispute and will show the status of your chargeback (in review, won or lost.)

What can I do on my end to prevent chargebacks?

As an owner/manager, it is your responsibility to collect all payment information from your customers. The best ways to prevent chargebacks from being initiated are:

-

Always verify the customer’s ID/Driver’s license matches the card before accepting the payment.

-

Always verify the order with your customer before placing it.

-

Always receive a signature when accepting a credit card in-store (digital is preferred using the customer touch display)

It is important to remember that even though you may practice the above principles, chargebacks may still occur. All employees you hire should be aware of these basic principles in order to optimize efforts in chargeback prevention.

My chargebacks with Online Ordering has increased, can I do anything to minimize this?

If your restaurant is experiencing an increase in chargebacks from Online Ordering, there are some operational processes that you can leverage to reduce this.

-

Increase the level of customer service. For example, if the customer's issue can be resolved with refunding, heavily consider it. You can submit full refunds for online orders on the POS, and partial refunds can be done by calling support. Once a chargeback is initiated by the customer, there is no way to refund the transaction.

-

Verify the credit card and/or the identification card for transactions over a self-specified threshold. Make this policy clear to your customers.

What is the acceptable chargeback rate?

Typically, if a restaurant goes over a chargeback rate of 0.75% to 1% (total # of chargebacks by count/total # of transactions by count), the restaurant will be notified and considered high-risk. In that case, you may need to review your chargebacks and make adjustments to fix the issues that cause the chargebacks. If the chargeback rate exceeds 1%, its account may be suspended or terminated.

What is my chargeback rate?

To calculate your chargeback rate, take the total number of chargebacks received and divide it by the total successful transactions done within a one month period. Chargeback rates are calculated for each card brand separately.

Shall I refund the charged back transaction?

Once you have been notified that a transaction has been charged back do not attempt to refund the customer for the transaction. A refund at that point in the process will not eliminate your responsibility of the chargeback. Rather the refund may result in a double refund to the customer (via refund and via chargeback). If, after receiving notice of a chargeback, you think that the cardholder needs to be refunded, then simply do not dispute the chargeback.

If I win a chargeback, can the cardholder challenge a 2nd chargeback for the same transaction?

Yes. Contesting a 2nd chargeback results in a phase known as pre-arbitration, in which the applicable card network (e.g., Mastercard, Visa, AMEX, Discover) will review all documentation to make the final decision. Most card brands attach a significant fee to these chargebacks.