Setting up and managing tax rates is crucial for maintaining accurate pricing and compliance with tax regulations. The Enterprise Menu's Taxes section provides a comprehensive toolset for adding, editing, and organizing tax rates, ensuring your menu items are correctly taxed. Whether you need to apply standard tax rates or manage special tax treatments, this article will walk you through the process.

Table of Contents

- Navigating the Taxes Section

- General Taxes

- Special Tax Treatments

- Multi-Location Features - Do you have multiple locations on EMS? Start here!

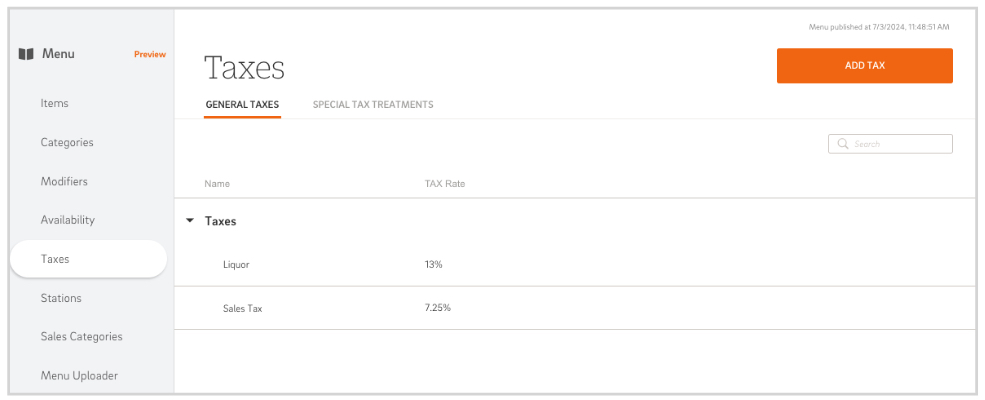

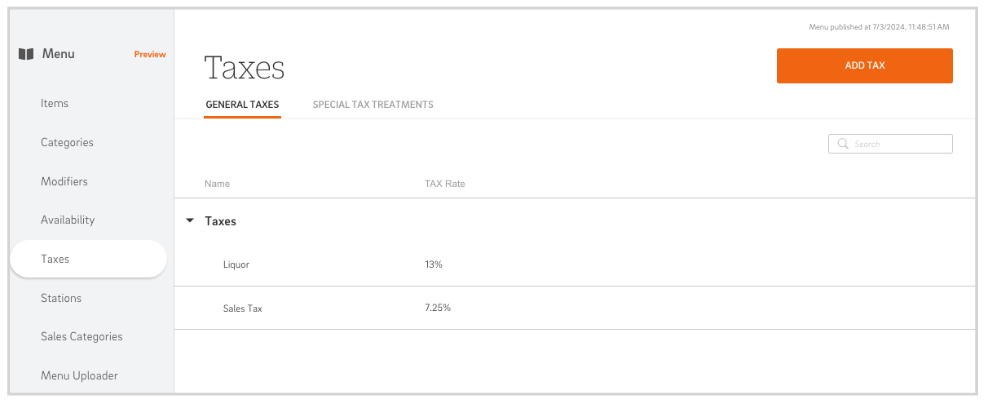

The Taxes tab allows you to add, edit, and view tax rates within your menu. There are two tabs within the Taxes section:

- General Taxes: View, add, and edit general taxes.

- Special Tax Treatments: Manage special taxes such as TO GO tax, service charge tax, and default tax.

The General Taxes tab is the first section within the Taxes area. Here, you can set up your general tax rates, which can then be assigned to menu items.

-

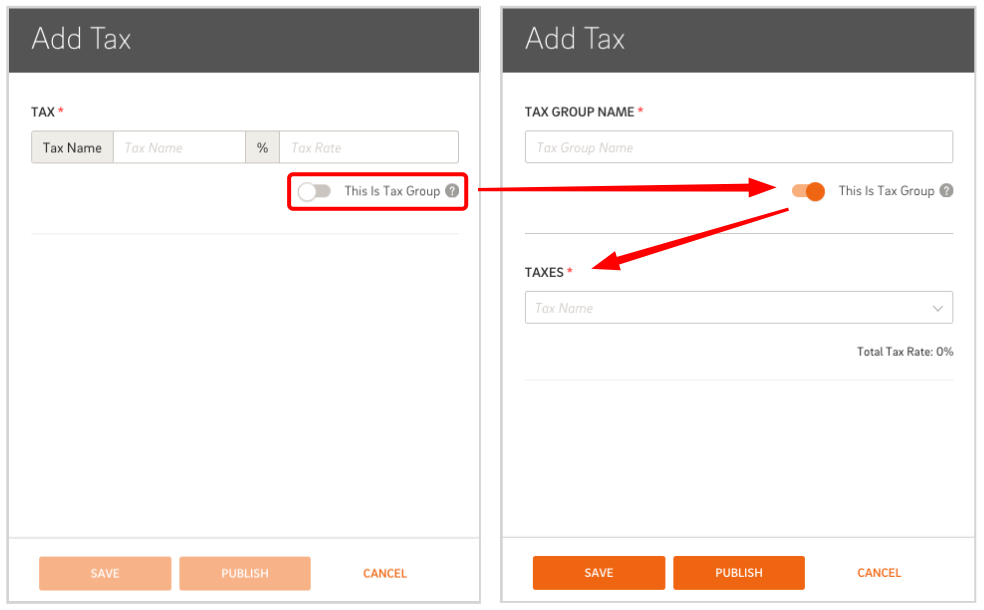

Add Tax:

-

Fill Out the Fields:

-

Save or Publish:

Add/Edit Taxes Menu:

Below is a breakdown of the various fields available when adding or editing a tax rate.

- When editing, view details on each field by hovering over the

icon to gain further insight.

icon to gain further insight.

| Field | Description |

| Tax Name | Name for the Tax Rate |

| Tax Rate | Tax rate percentage |

| 'This is Tax Group' Toggle | Toggle ON to allow nesting multiple tax rates under one group. Once toggled on, a Taxes field will appear. Select the desired tax rates for the group. |

NOTE:

- Duplicate tax names cannot be created.

- If a Tax Rate has assigned categories or items, it cannot be deleted.

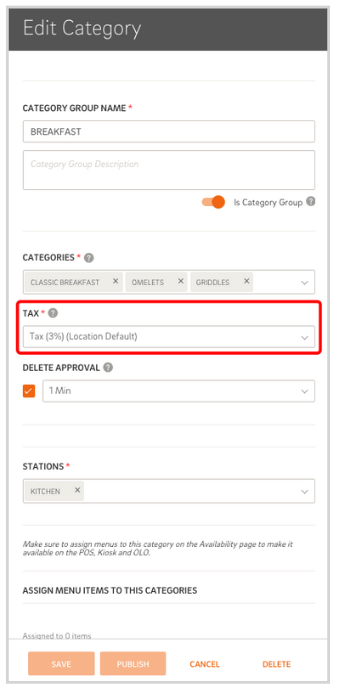

Once a tax rate is saved, it will be available as a tax rate option in the Edit Item or Edit Category menu.

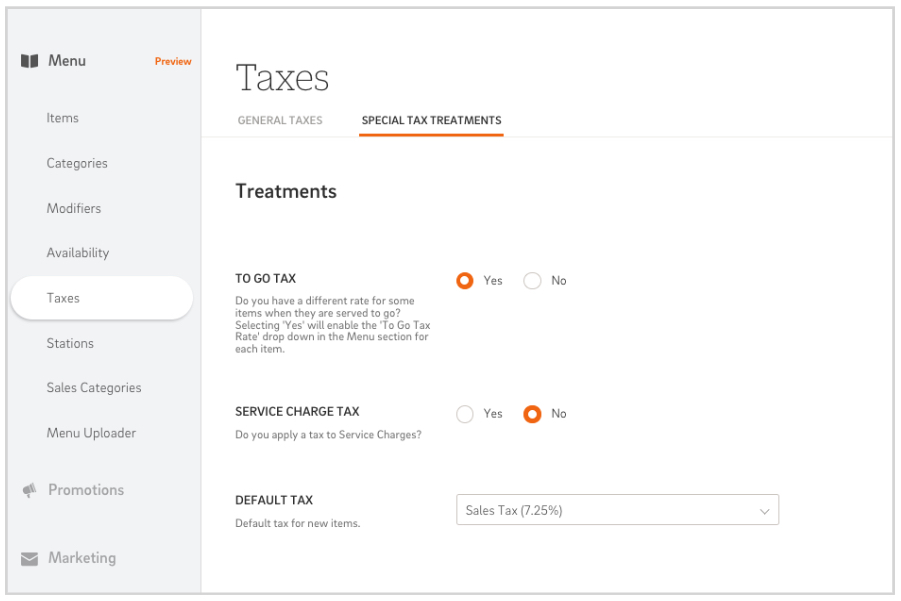

The Special Tax Treatments tab is the second section within the Taxes area. Here, you can manage special tax treatments.

Special Tax Options:

| Field | Description |

| To Go Tax | Select YES to set a TO GO tax rate within an Edit Item menu. |

| Service Charge Tax | Select YES if you apply a tax to Service Charges.

Once Yes is selected, an additional field will appear that will prompt you to select a service charge tax from your existing general taxes list. |

| Default Tax | Choose your default tax rate. New items added to your menu will have this tax rate by default. |

Best Practice: To ensure consistency and streamline updates across all locations, it's crucial to make all menu edits at the Enterprise Level. Editing at the individual location level can cause disconnections between the enterprise and location menus, which can result in future updates not being reflected at the location level. Always edit from the Enterprise Level to maintain consistency and ensure all locations are up-to-date with the latest menu changes.

Features

For businesses with multiple locations, the Enterprise Menu offers enhanced flexibility and control through its multi-location features. Here’s a detailed look at these capabilities:

-

Tax Creation:

-

Taxes can be created at both the enterprise and location levels.

-

Once created, taxes will be available for all locations to use.

-

Editing Tax Details:

-

Deleting Taxes:

FAQ

Q: How do I access the Enterprise Level?

A: To access the Enterprise Level, follow these steps:

-

Log into CAKE Admin Portal: Log into CAKE Admin Portal and select the Menu Admin icon.

-

Select the Enterprise Level: You will be prompted to select the location you would like to access. Choose the Enterprise level, identifiable by the arrow to the left of the enterprise name. Selecting the arrow will reveal the locations within the enterprise.

Q: What happens if I make an edit at the location level?

A: Editing at the location level can create inconsistencies between the location menu and the enterprise menu. Future updates made at the enterprise level will not affect fields that were edited at the location level. To maintain a seamless connection and ensure updates are reflected across all locations, always make edits at the enterprise level. If a disconnection occurs, contact support to re-establish the connection.

Q: What if I only need to update the menu for one of my locations?

A: For menu data specific to a single location, it's best to create it at the enterprise level. Use the availability field to designate which location can access it. This approach allows for easy expansion to other locations in the future by simply adjusting the availability settings.

^^Back to Top

Enterprise Menu Navigation Page