The CAKE POS system provides flexible payroll settings to align with your business policies and comply with state and local labor laws. This guide explains how to configure your Payroll System Options for accurate time tracking and payroll management.

Table of Contents

- Accessing Payroll System Options

- Payroll Settings

- Best Practices

- Quick Summary Table

To access Payroll System Options, follow these simple steps on your POS system:

-

- Go to the Main Menu.

- Select Settings.

- Navigate to System Options.

- Click on the Payroll tab.

Once you’re on the Payroll tab, you’ll have access to a variety of settings to streamline your payroll.

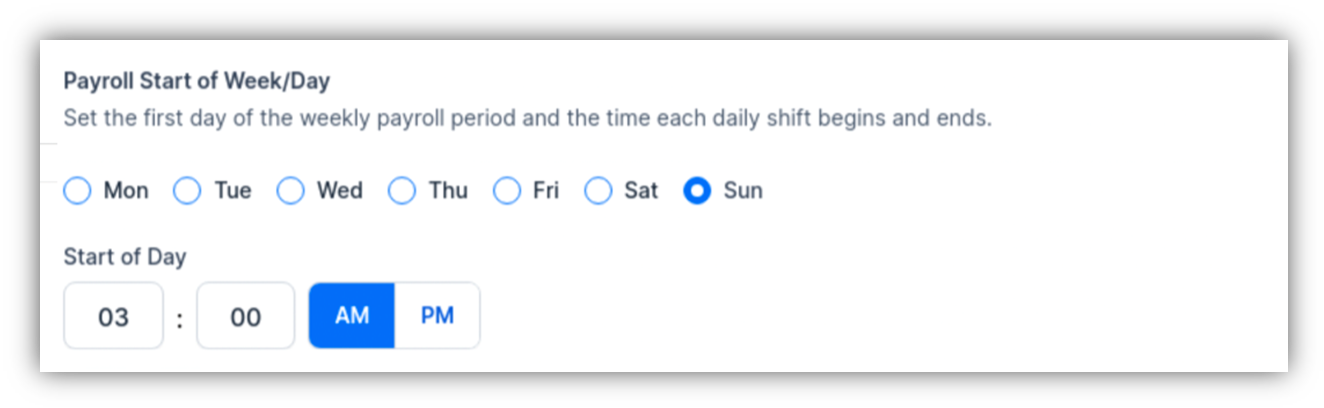

1. Payroll Start of Week/Day

- Purpose:

- Specifies the day and time your payroll week begins.

- How to Configure:

- Select the start day and time to match your payroll schedule.

- Recommendation:

- Align this setting with your company’s pay period start to ensure accurate payroll calculations.

- Purpose:

- Allows you to designate a specific amount of paid break time for employees during their shifts.

- How It Works:

- When employees clock out for a break, the system displays the allotted paid break time.

- Recommendation:

- Toggle this ON if your business offers paid breaks and set the duration in compliance with labor laws.

- Purpose:

- Designates paid meal periods for employees during their shifts.

- How It Works:

- When employees clock out for a meal, the system displays the allotted paid meal time.

- Recommendation:

- Toggle this ON if your business offers paid meal periods. If not, keep it OFF.

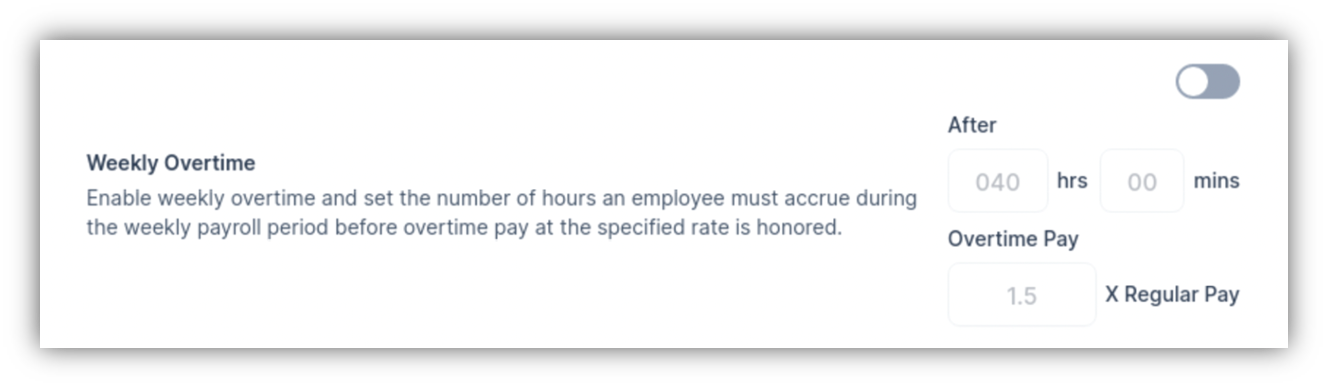

- Purpose:

- Defines the weekly hours threshold for overtime pay and the overtime pay rate.

- How to Configure:

- Toggle ON and enter the threshold (e.g., 40 hours) and the applicable pay rate multiplier (e.g., 1.5x or 2x).

- Recommendation:

- Enable this setting if your location requires overtime pay after a certain number of weekly hours.

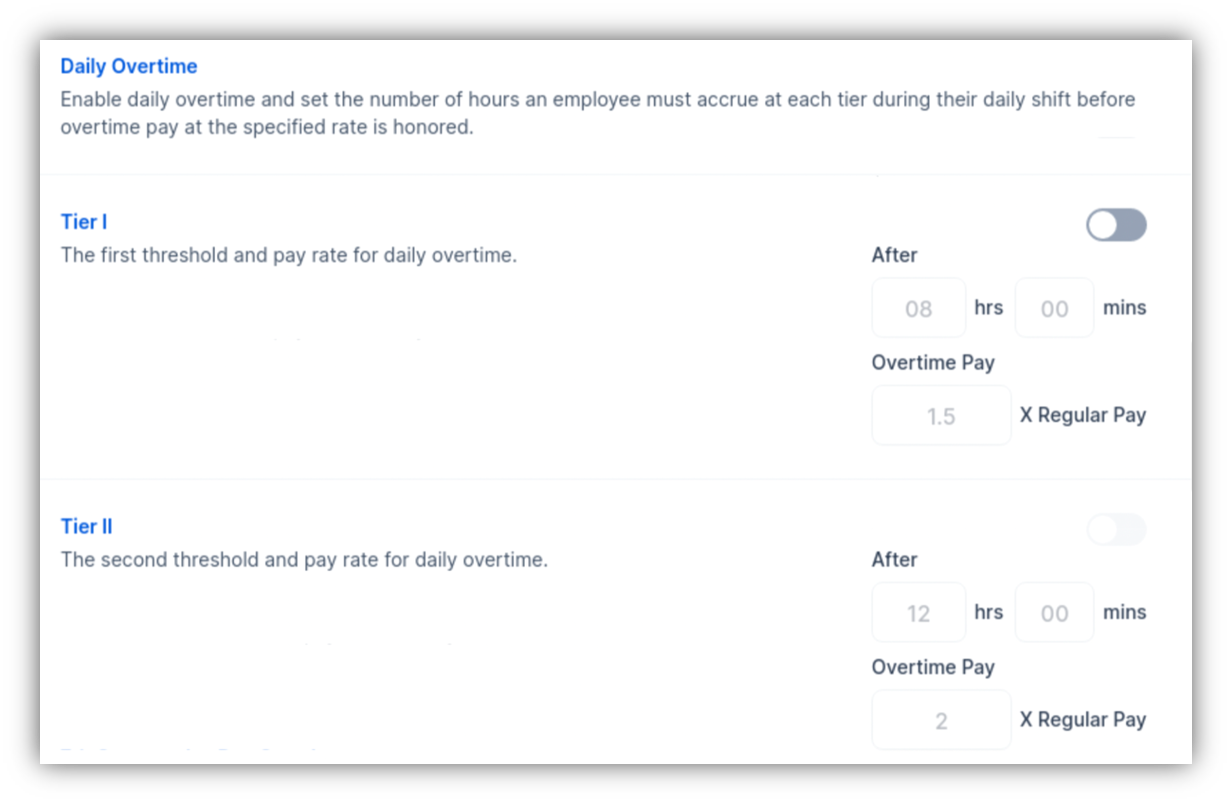

- Purpose:

- Configures daily overtime rules, including two tiers for different thresholds (e.g., +8 and +12 hours).

- How to Configure:

- Set the daily thresholds and rates for Tier 1 and Tier 2.

- Recommendation:

- Enable and configure this if your location mandates daily overtime pay.

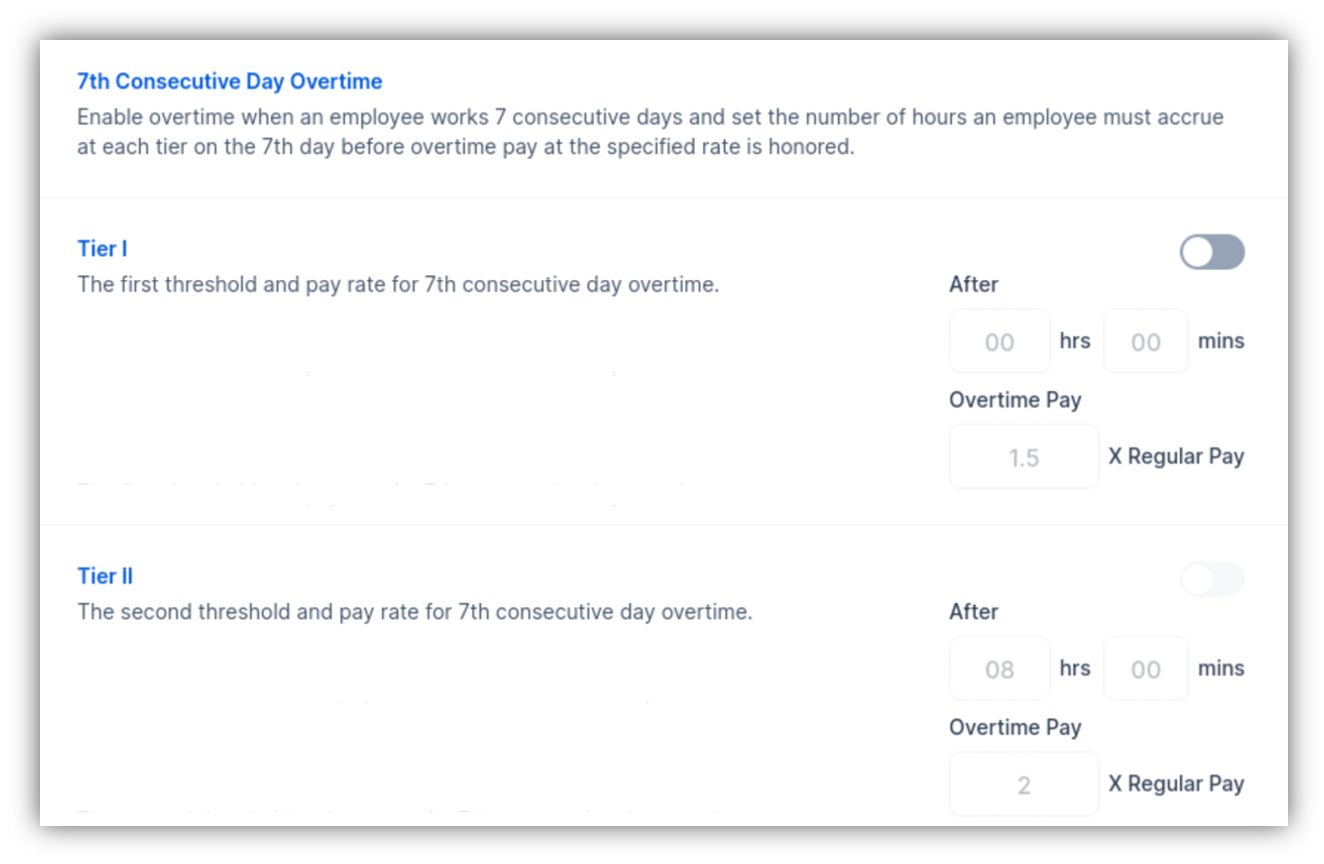

- Purpose:

- Configures overtime rates for employees working seven consecutive days in a week.

- How to Configure:

- Toggle ON and enter the pay rate multipliers for Tier 1 and Tier 2 overtime on the 7th consecutive day.

- Recommendation:

- Enable this setting if applicable to your local labor laws.

- Purpose:

- Allows daily overtime hours to count toward weekly overtime totals.

- Recommendation:

- Enable this setting to ensure comprehensive overtime calculations.

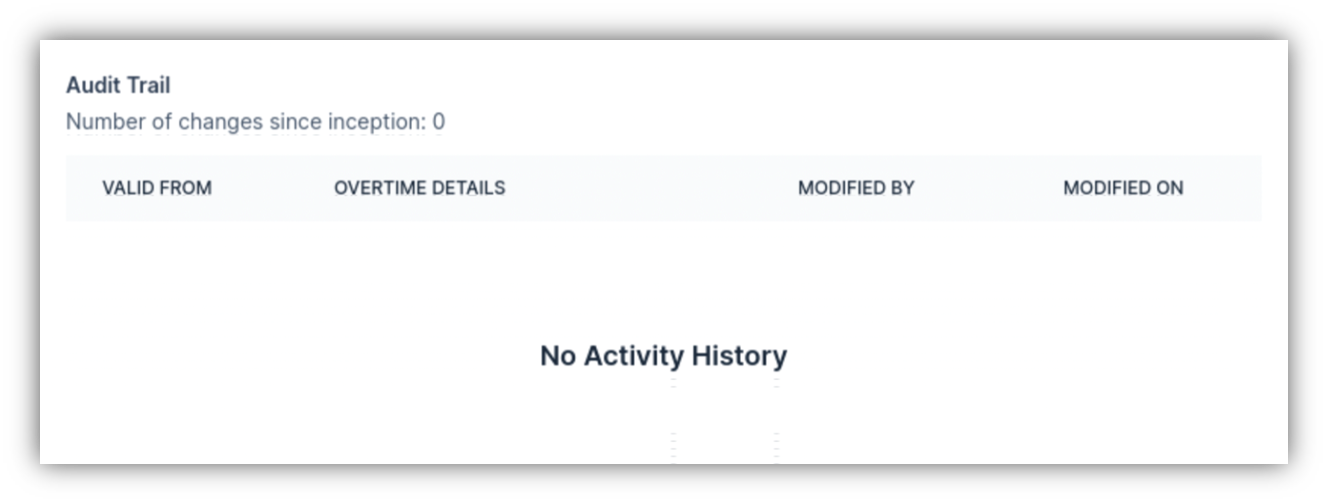

- Purpose:

- Tracks changes made to payroll settings, including who made the changes and when.

- Recommendation:

- Regularly review the audit trail for accountability and compliance purposes.

- Align Settings with Labor Laws:

- Configure settings based on your state and local overtime and break laws.

- Enable Audit Trail:

- Use the audit trail to monitor changes and ensure compliance.

- Test Settings:

- Verify settings with sample employee time data to ensure accurate calculations.

- Review Weekly and Daily Overtime:

- Double-check tiered overtime rules for locations with complex regulations.

| Setting | Purpose | Recommendation |

|---|

| Payroll Start of Week/Day | Specifies the payroll week start. | Align with your pay period schedule. |

| Paid Breaks | Defines paid break duration. | Enable if required by labor laws. |

| Paid Meals | Specifies paid meal periods. | Enable if your business provides paid meals. |

| Weekly Overtime | Configures weekly overtime thresholds and rates. | Enable to comply with local regulations. |

| Daily Overtime | Sets daily overtime rules with two tiers. | Configure if applicable. |

| 7th Consecutive Day Overtime | Defines overtime pay for seven consecutive workdays. | Enable if required by local laws. |

| Overtime Carryover | Allows daily overtime to count toward weekly overtime. | Enable for comprehensive calculations. |

| Audit Trail | Tracks changes to payroll settings. | Regularly review for compliance and accuracy. |

Proper configuration of payroll settings ensures compliance with labor laws, accurate time tracking, and fair pay for employees. Adjust these settings based on your local and state regulations, and always Save Changes after making updates. For further help, contact CAKE support via phone at (352)722-2253.

Review Online Ordering Settings Next

Return to System Options Overview