Getting started with CAKE Payments is simple and straightforward—this guide will walk you through the application process, from setup to approval, and show you how to manage payments and reports with ease.

Table of Contents

To get started with CAKE Payments, follow these steps to complete the application:

- Log in to the CAKE Admin Portal and select the Payments Onboarding icon.

- If managing multiple restaurants, choose the specific restaurant you want to onboard to CAKE Payments from the drop-down menu.

- Review the CAKE Payments information provided.

- Select Continue to proceed.

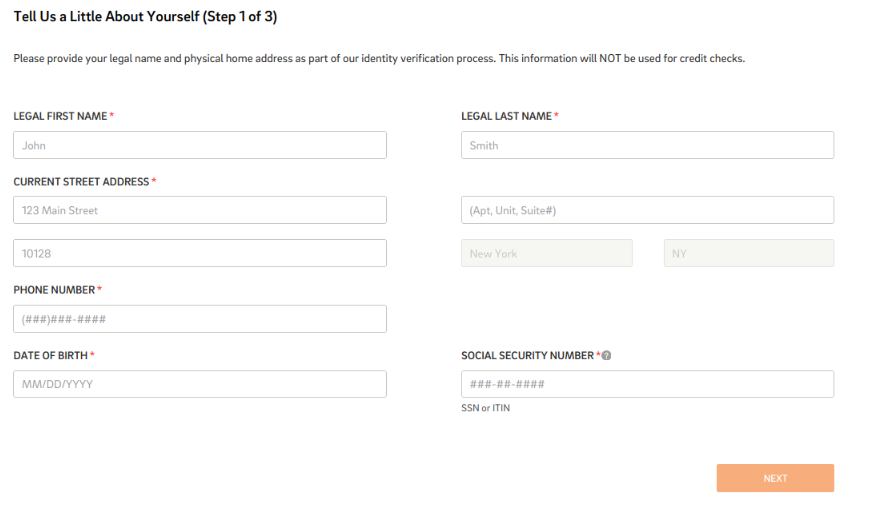

- Enter your personal information such as name, address, and phone number.

- Note: P.O. Boxes are not accepted for business or home addresses.

- To continue, select next.

-

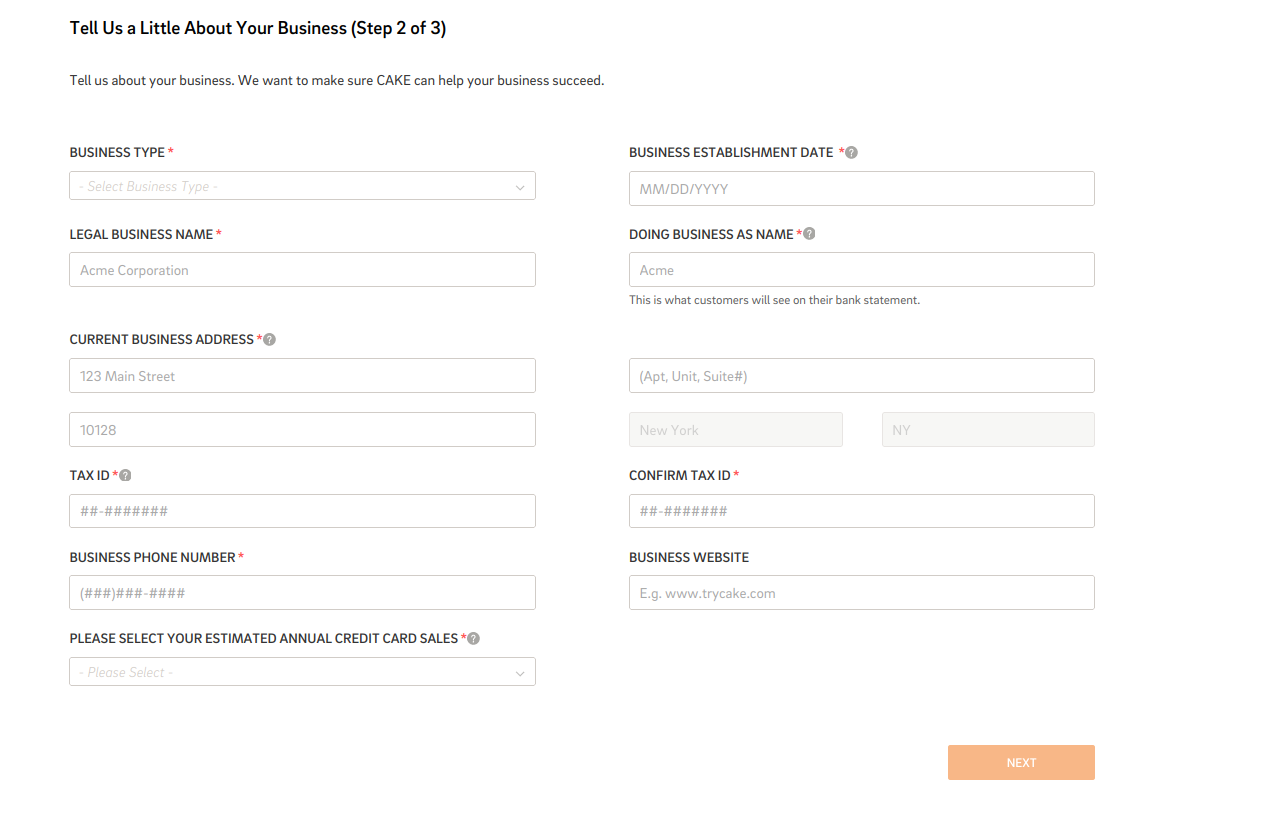

Doing Business As Name: This is the name that will appear on your customers' credit card statements.

-

Business Type: Choose from five business types:

- Limited Liability Company (LLC): A US-specific form of a private limited company.

- Sole Proprietor: A business run by a sole trader.

- Corporation: An independent legal entity owned by shareholders.

- Partnership: A single business where two or more people share ownership.

- Non-Profit: A business with the goal of serving the community, not making a profit.

-

Business Street Address: Make sure to use a physical address; PO Box addresses are not accepted.

-

Tax ID:

- Mandatory for all business types (except Sole Proprietor) and located below the "Business Phone Number" field.

- Your Tax ID must be accurate for the issuance of your 1099K for tax purposes.

-

Estimated Annual Credit Card Sales:

- Select from the drop-down list ranging from $10,000 to $5,000,000.

- Note: This choice does not impact your CAKE Payments application.

-

Business Establishment Date:

- Appears next to the "Business Type" field when the "Non-Profit" business type is selected.

- This is the date your business was established. This date is used solely for underwriting purposes.

-

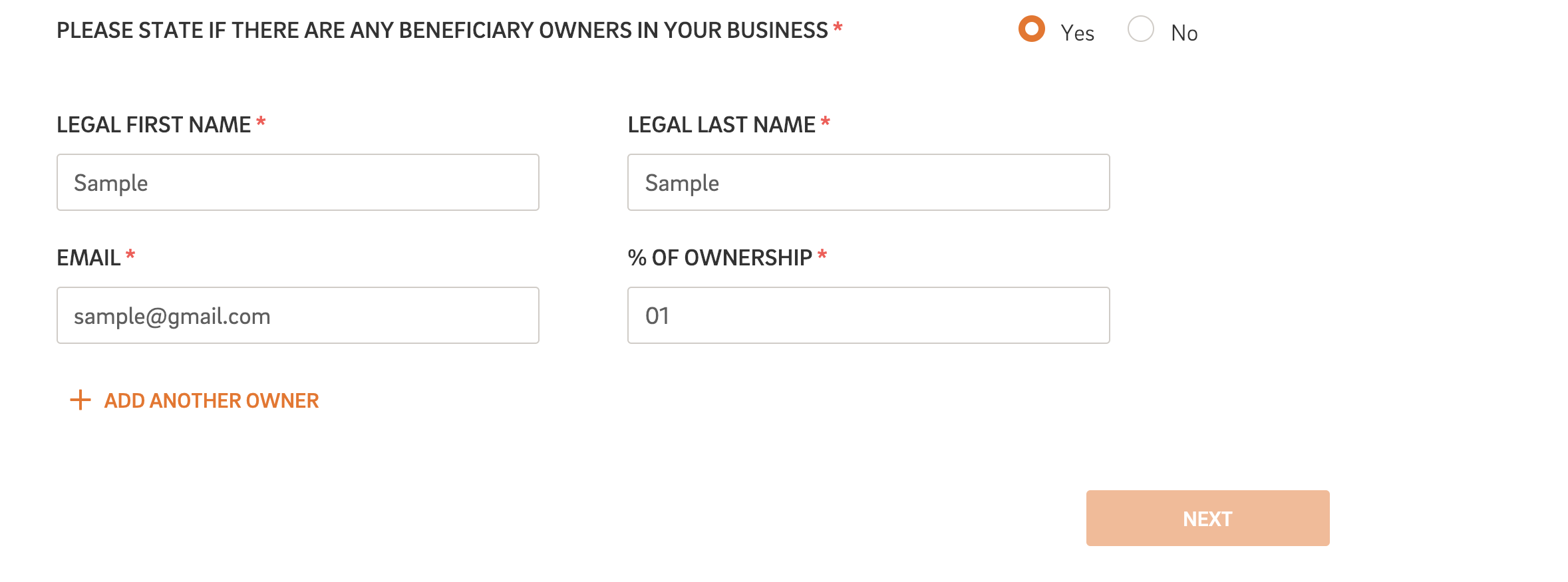

Beneficiary Owner Details:

-

By default, the option is set to No.

-

If Yes is selected, enter details for up to three Beneficiary owners:

- Legal First Name

- Legal Last Name

- Email Address

- Ownership Percentage (1 - 99%)

-

Selecting Next sends an email to all Beneficiary owners listed on the form.

Note:

- P.O. Boxes are not accepted for business addresses.

- Tax ID is not required for Sole Proprietor business type.

- The fields required will vary based on the selected Business Type.

- If you receive an error that states "Zip code cannot be verified," it may indicate an incorrect Zip code.

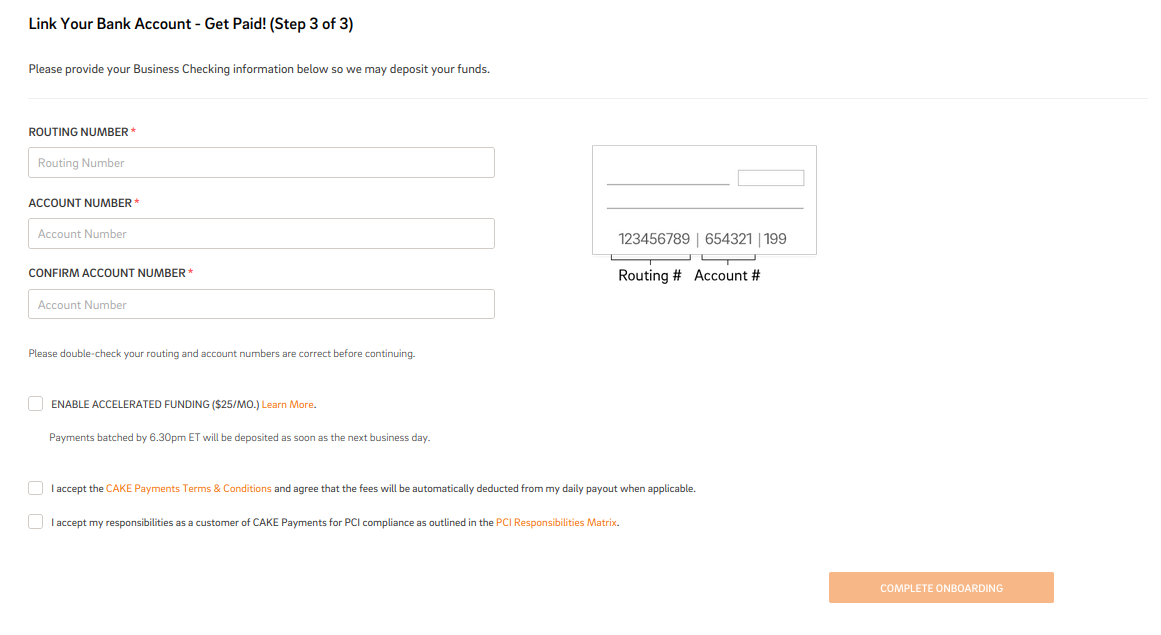

- Enter Routing Number (9 digits)

- Enter Account Number (twice)

- Check the I accept boxes for Terms & Conditions and PCI Compliance Responsibilities to proceed.

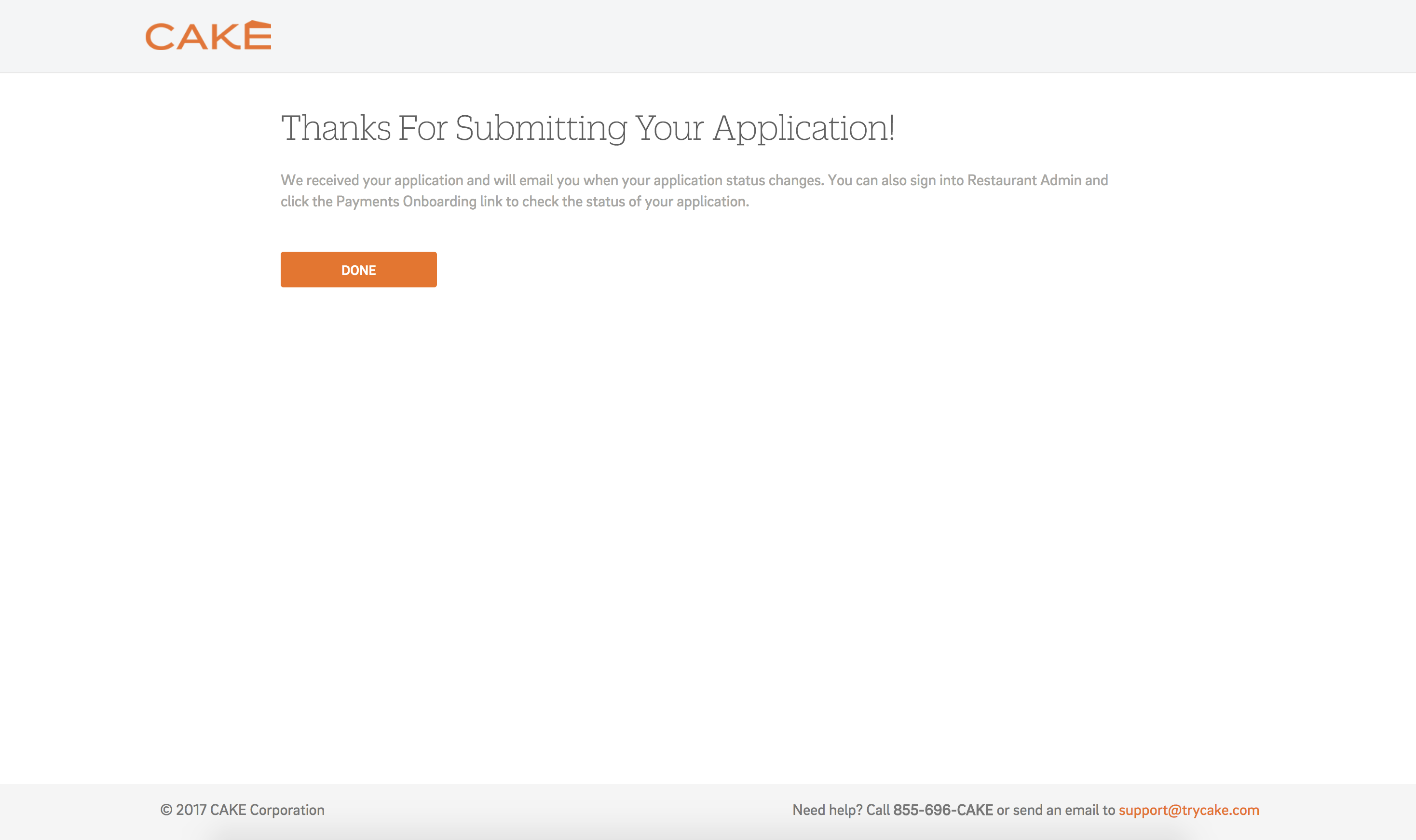

Approval Notification:

After submitting your application:

- You will see a confirmation screen indicating successful submission.

- The review and approval process takes up to 96 hours.

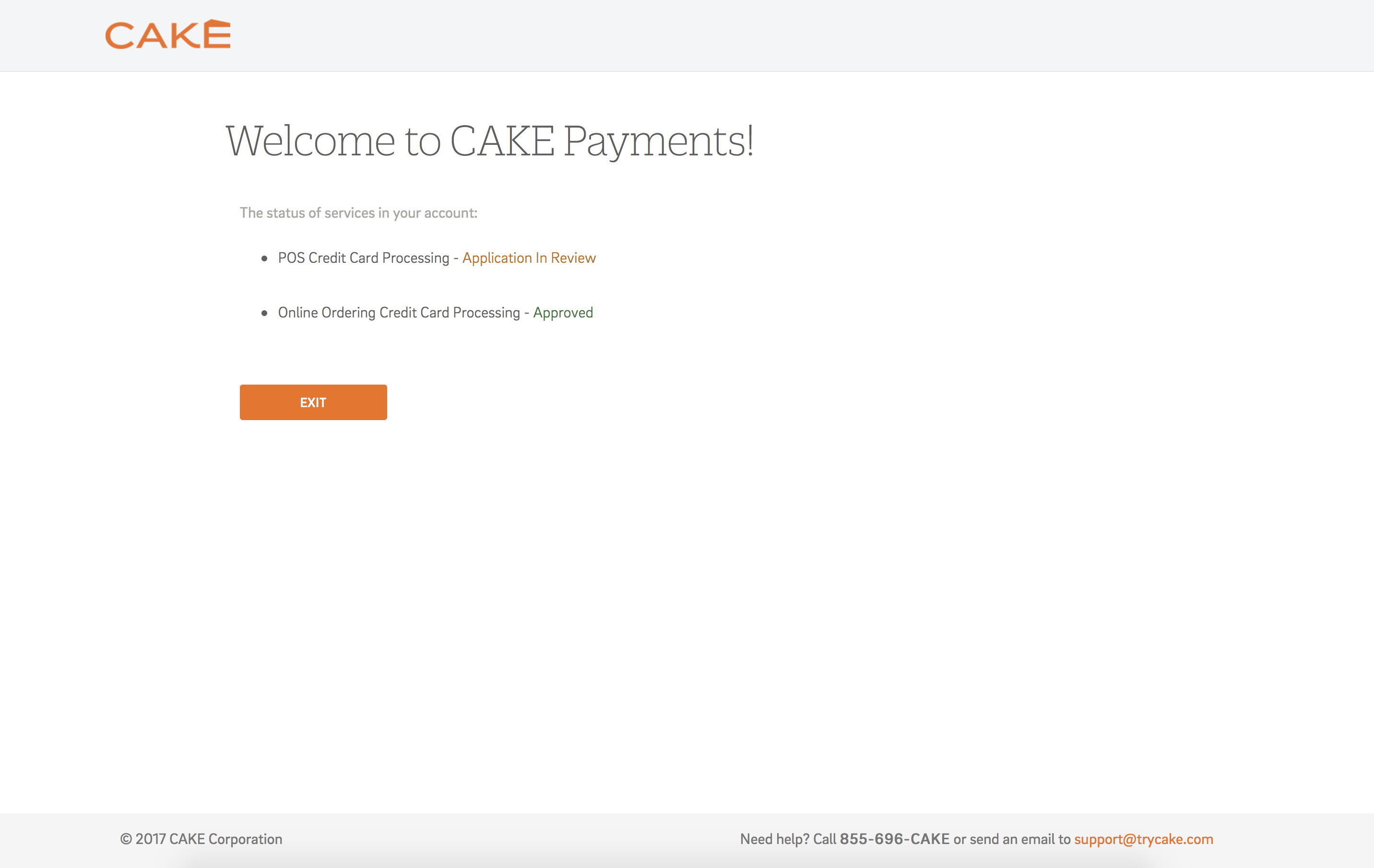

- Check your application status via the Payments Onboarding icon in the CAKE Admin Portal.

- Upon approval, you will receive an email, and you can start accepting credit card payments immediately.

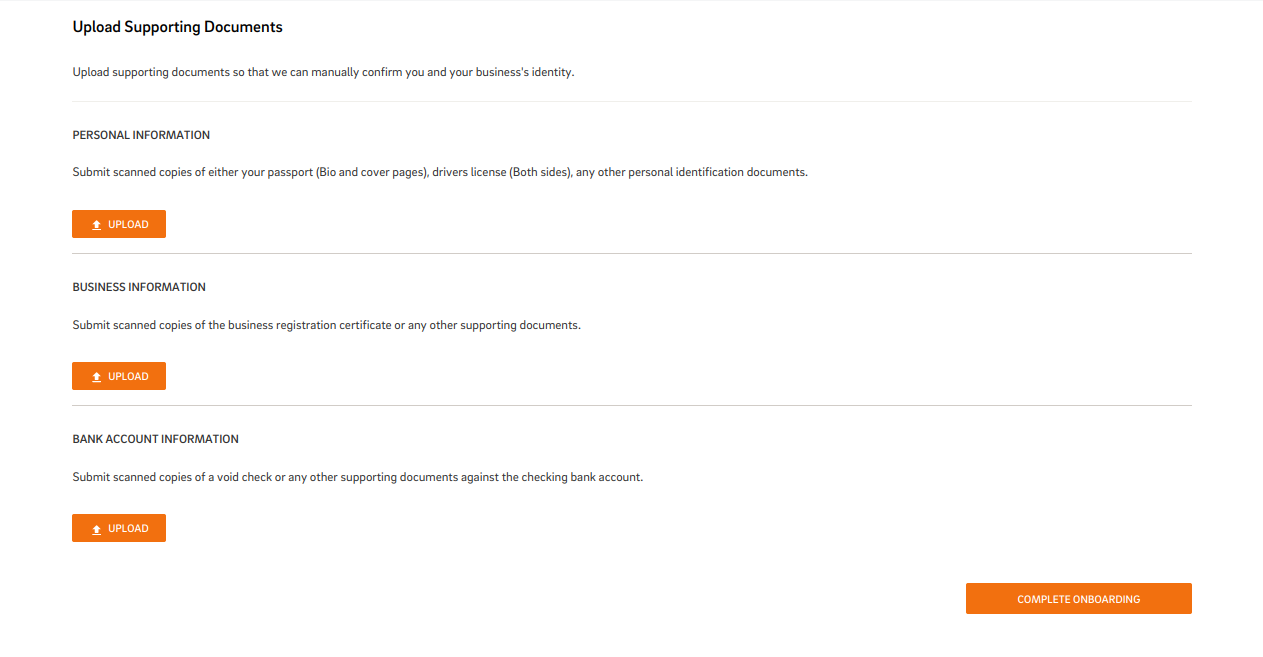

- If details fail verification, you may upload supporting documents on the designated page.

- Note: Uploading documents is optional but may expedite the resolution process.

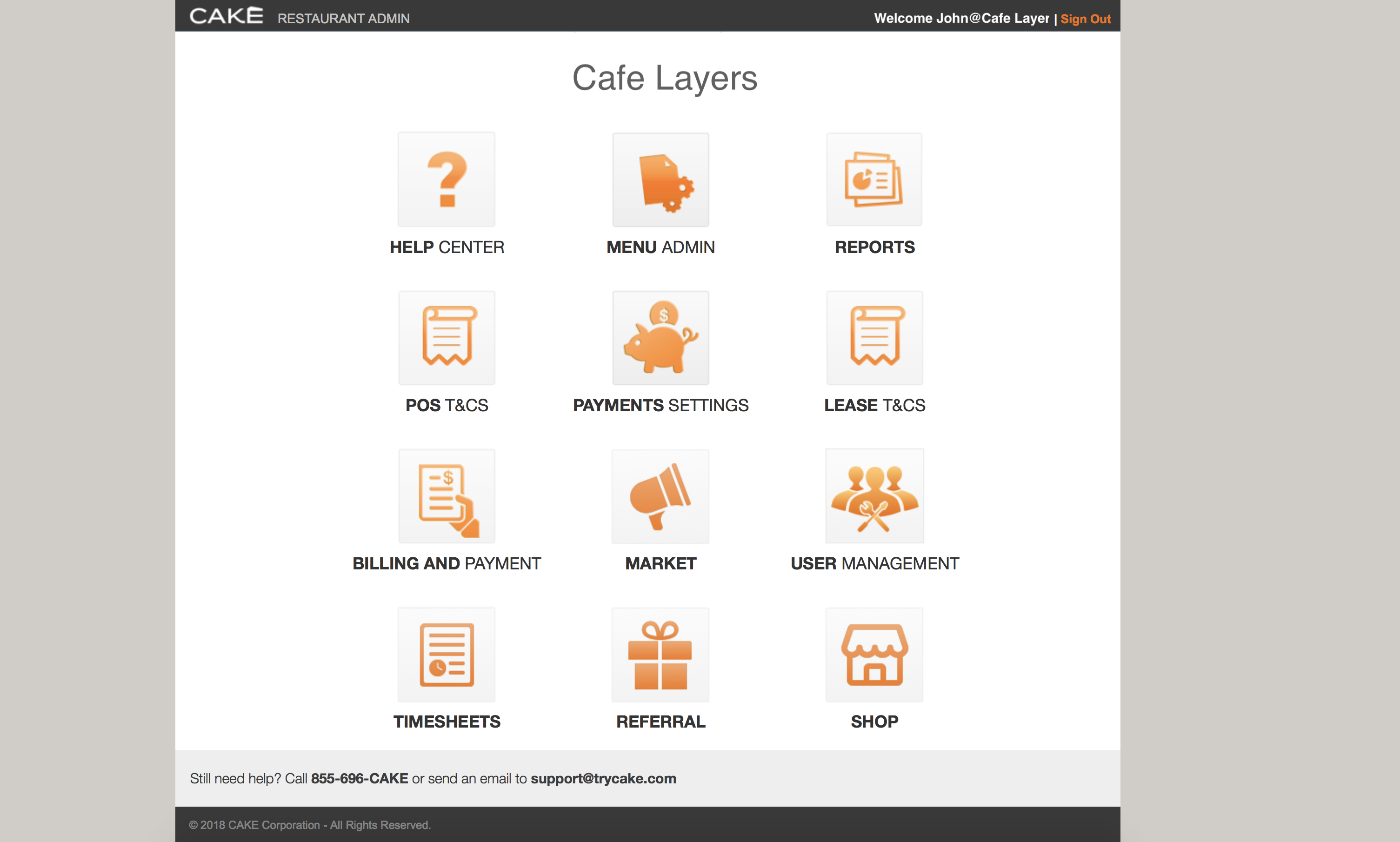

Once approved:

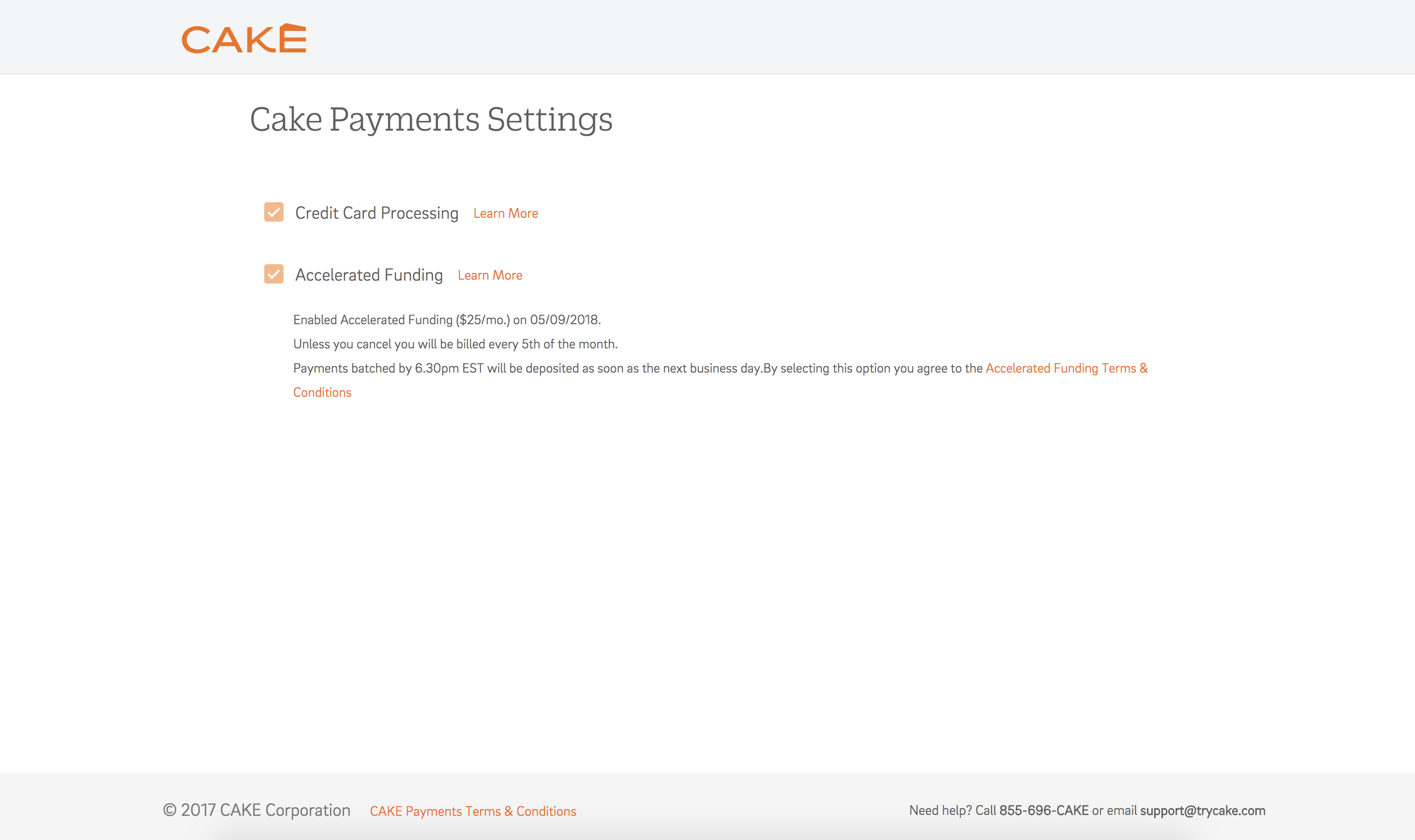

- The Payments Onboarding icon in the CAKE Admin Portal will change to Payments Settings.

- Navigate to Payments Settings to confirm Credit Card Processing is enabled.

- If you didn't enable Accelerated Funding during setup but would like to activate it in the future, simply select the Payment Settings icon.

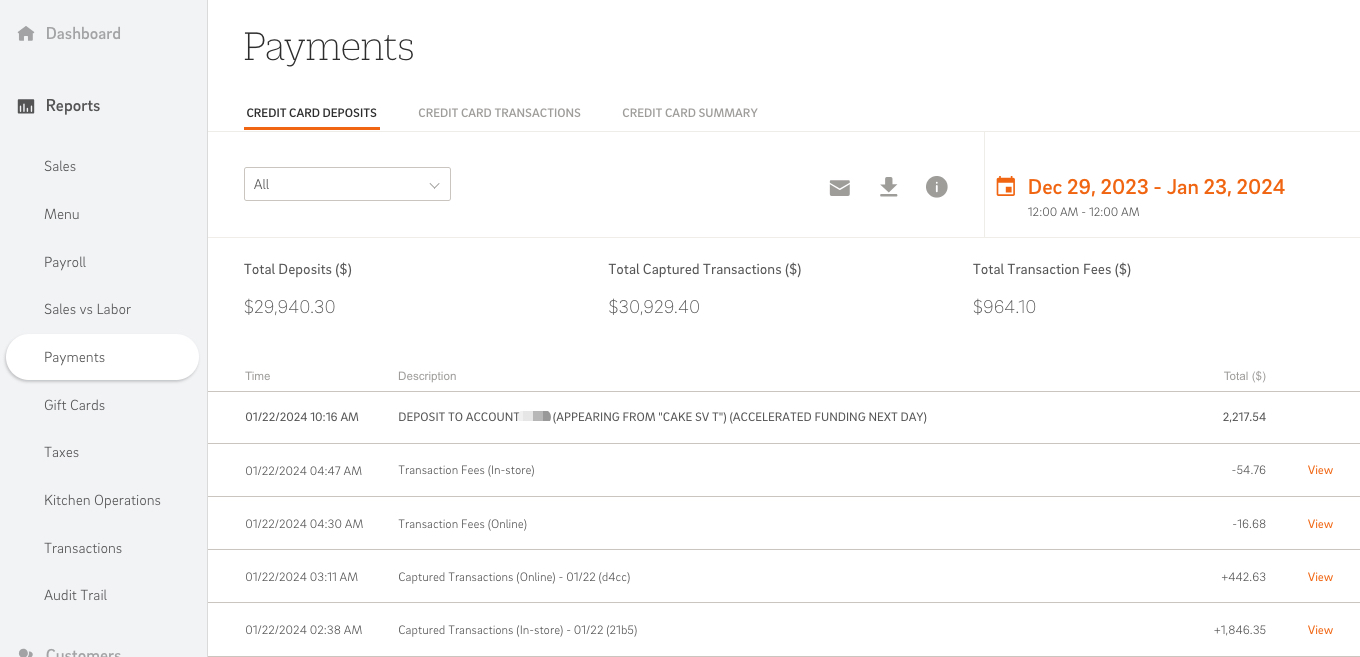

To review Payments related information view the Payments report in CAKE Admin Portal.

- The Payments Report will list captured transactions per close cash batch, CAKE fees deducted, and your deposits.

- To learn more about this report review our Cake Dashboard: Payments Report article.

With CAKE Payments, managing transactions and streamlining payment processes has never been easier. By following this guide, you’ll have everything you need to set up your account, address any application errors, and access valuable reports. If you need further assistance, don’t hesitate to explore our additional resources or reach out to CAKE Support via call or text at (855)696-2253.