Table of Contents

- Payroll Report Introduction

- Payroll: Labor Costs

- Payroll: Tips & Cash

Payroll reports are essential tools for monitoring employee work hours, calculating labor costs, and managing financial transactions, such as tips and cash sales. These reports provide critical insights for effective financial management and workforce scheduling.

Key reports included:

- Labor Costs Report: This report provides detailed information about employee work hours and associated costs, helping you manage your workforce and resources efficiently.

- Tips & Cash Report: It offers a comprehensive view of tips, service charges, and cash transactions, ensuring accurate financial record reconciliation and optimization.

Back to Top

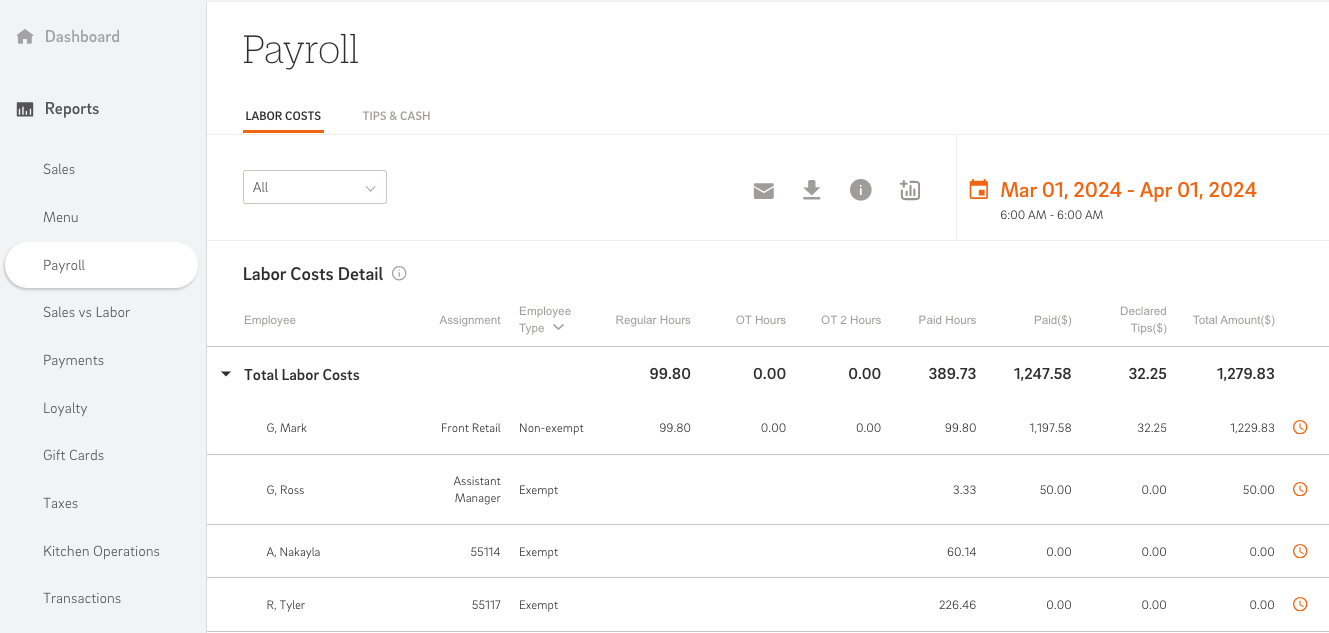

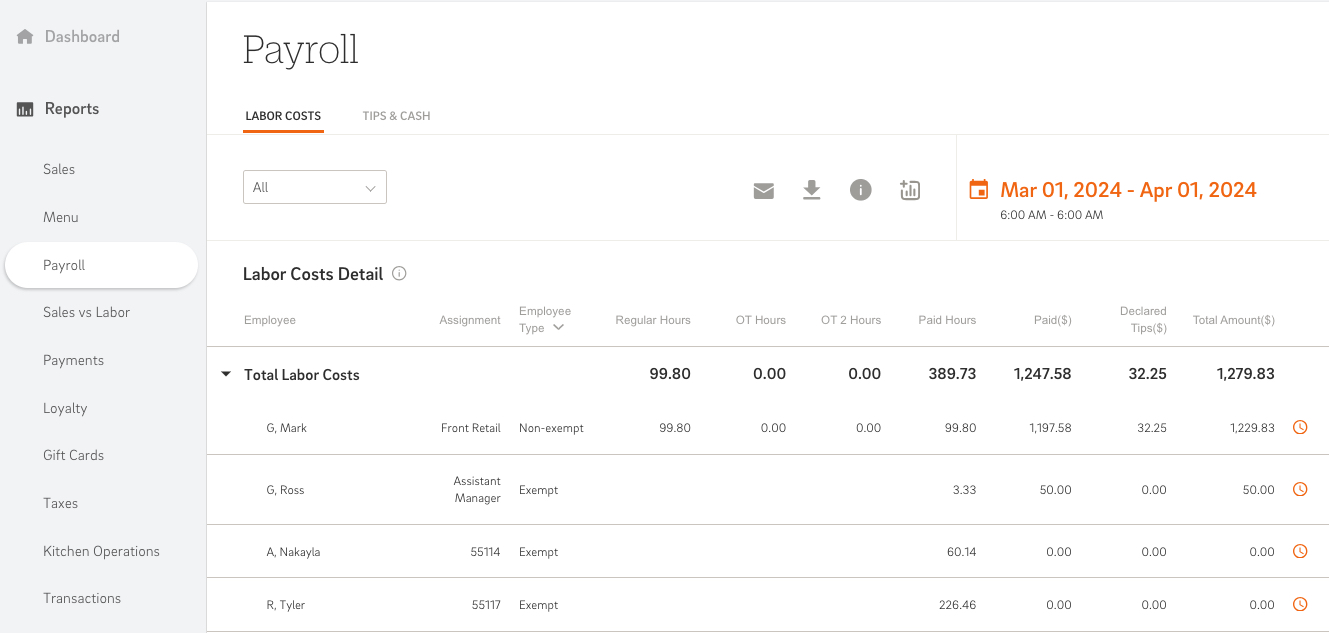

Payroll:Labor Costs

The Payroll: Labor Costs report is your go-to tool for tracking employee work hours, including both regular and overtime hours, over a specific period. It not only monitors the hours worked but also calculates the associated labor costs. Each entry in the report details an employee's work hours and their assigned job role.

- Standard vs Overtime Hours: The report distinguishes between standard and overtime hours based on the Payroll Settings in the POS system. This classification considers whether an employee is exempt or non-exempt, as set in the Job Assignment settings. Remember, exempt employees won't accumulate overtime hours.

- Job Assignment: Each employee's record in the report shows their designated job role for every clock-in. For a detailed view of open shifts and clock-in/clock-out records, you can head over to the Timesheets article.

- Accessing Timesheets Beyond 30 Days: Need timesheet data from more than 30 days ago? Simply download the Excel version of the Payroll report for your desired date range. This downloadable report provides a comprehensive overview of historical timesheet details, making it easy to access past data.

- PDF by Employee: You can download each employee's information as a PDF for the selected date range. The system generates a zip file containing individual PDFs for each employee, giving you a neat and organized snapshot of their work hours.

Data Table:

The data table in the Payroll: Labor Costs Report consists of the following columns:

- Employee: Name of the employee

- Assignment: Job assignment of the employee

- Employee Type: Type of employee (Exempt or Non-Exempt)

- Regular Hours: Total regular hours worked by the employee

- OT Hours: Total overtime hours worked by the employee

- OT 2 Hours: Total double overtime hours worked by the employee

- Paid Hours: Total hours for which the employee is paid

- Paid ($): Total payment made to the employee for the hours worked

- Declared Tips ($): Total amount of tips declared by the employee

- Total Amount ($): Total amount paid to the employee, including declared tips

Formulas:

- Non-Exempt Employee

- Paid Hours: Regular Hours + OT Hours + OT2 Hours

- Paid: (Regular Hours * wage) + (OT Hours * Overtime Pay) + (OT2 Hours * Overtime Pay)

- Total Amount: Paid + Declared Tips

- Exempt Employee

- Paid Hours: Total Hours Worked

- Paid: Total Hours Worked * Hourly Rate (Exempt Employee)

- Total Amount: Paid + Declared Tips

Back to Top

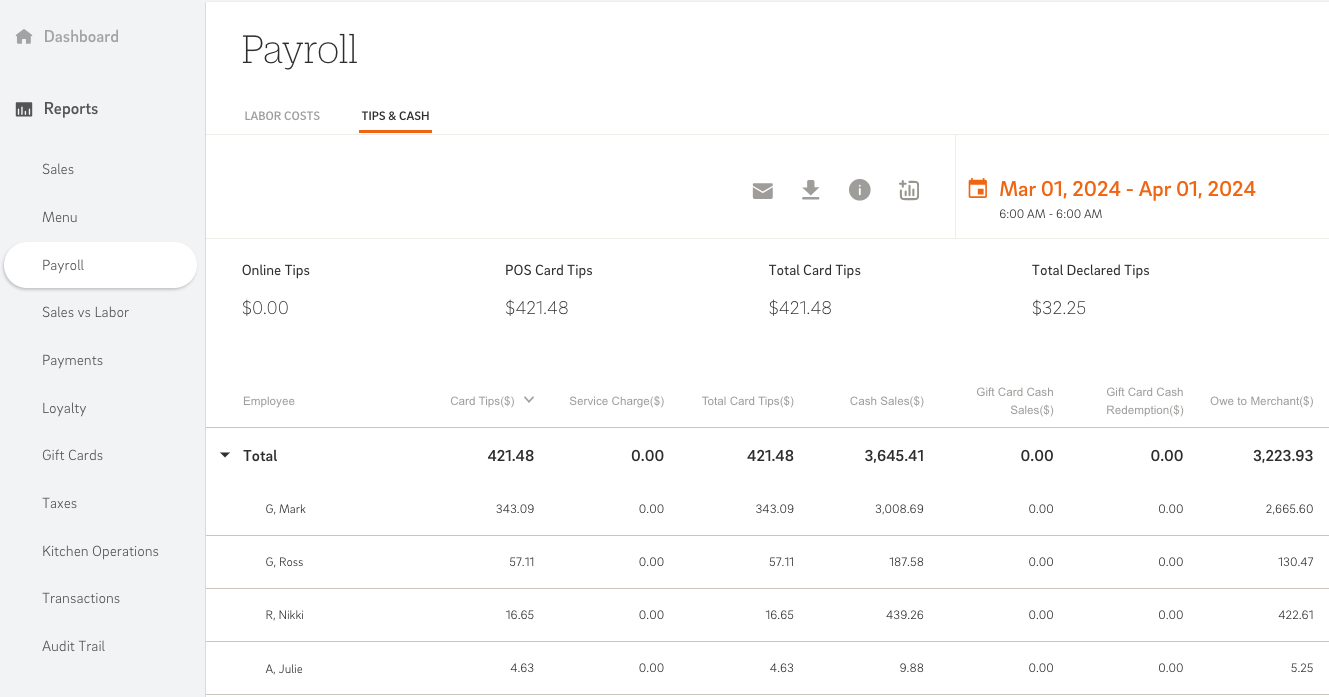

Payroll: Tips & Cash

The Payroll: Tips & Cash report offers a detailed breakdown of tips, service charges, cash sales, and gift card transactions, including both sales and redemptions. This report is crucial for reconciling cash collected during service periods with other payment forms and tips. It helps staff determine the amount to return to the restaurant or vice versa. The report also details any tip adjustments and distinguishes between card tips, auto-gratuities (like those for large parties), and online tips for clarity.

Key Metrics and Definitions:

Let's explore the key metrics included in the Payroll: Tips & Cash report:

- Online Tips: Total online sales tips

- POS Card Tips: Total POS card tips

- Total Card Tips: Online Tips + POS Card Tips

- Total Declared Tips: Total declared tip amount from labor cost report

Data Table:

The data table in the Payroll: Tips & Cash Report consists of the following columns:

- Employee: Name of the employee

- Card Tips ($): Total card tips received by the employee

- Service Charge ($): Total service charges collected by the employee

- Total Card Tips ($): Sum of Card Tips and Service Charge

- Cash Sales ($): Total cash sales made by the employee

- Gift Card Cash Sales ($): Total cash sales made selling gift cards by the employee

- Gift Card Cash Redemption ($): Total amount redeemed from gift cards by the employee

- Owe to Merchant ($): Amount owed to the merchant

Formulas:

- Total Card Tips = Card Tips + Service Charge

- Owe to Merchant = (Cash Sales - Total Card Tips) + (Gift Card Cash Sales - Gift Card Cash Redemption)

Back to Top

Mastering CAKE Reports