This guide provides a comprehensive breakdown of the information presented on the Close Cash receipt, ensuring you understand each section clearly and thoroughly. From sales summaries to payment details, you’ll gain the knowledge needed to accurately interpret and utilize this essential document for your business operations.

Table of Contents

- Close Cash Introduction

- Breakdown of Sections

The Close Cash receipt is an essential document summarizing the sales and financial activities of a business day. This guide provides a detailed breakdown of each section of a Close Cash receipt to help you understand and interpret their daily financial summary accurately.

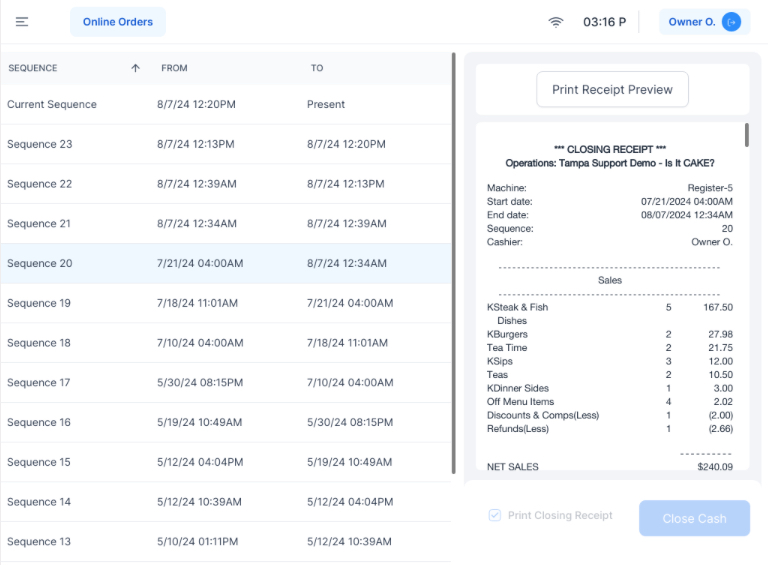

This section includes the essential details about the business operations for the day.

- Machine: Indicates the specific register or machine used.

- Start Date and Time: When the business day or shift began.

- End Date and Time: When the business day or shift ended.

- Sequence: Unique identifier for the transaction period.

- Cashier: The name or ID of the cashier handling the transactions.

2. Sales Summary

This section details the total sales categorized by menu categories.

- Categories: Lists all menu categories (e.g., sandwiches, burgers, beverages) with quantities sold and the total amount.

- Net Sales: Total sales amount after discounts and comps.

- Tax: Total tax collected on sales.

- Extra Fee: Total amount of POS extra fee.

- Gross Sales: Total sales amount before tips.

- Total Tips: Amount of tips collected.

- Total: Extra Fee + Gross sales + Tips.

- Total Order Count: Number of orders processed.

- Average Sales per Order: Average amount spent per order.

- Total Guest Count: Number of guests served.

- Average Sales per Guest: Average amount spent per guest.

- Average Guests per Order: Average number of guests per order.

3. Taxes

This section provides a detailed breakdown of the taxes collected on sales.

-

Tax Rates: Displays each tax rate applied, along with the total amount of tax collected for each rate.

-

Total Tax: Shows the combined total of all taxes collected during the business day.

4. Payments

Details of payments received through various methods.

- Card Payments: Breakdown by card type (e.g., Visa, Amex, MasterCard) including the number of transactions and total amount.

- Cash Payments: Total amount received in cash.

- Total Payment: Sum of all card and cash payments.

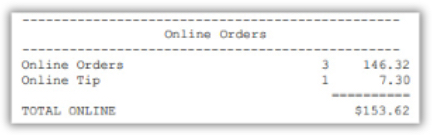

5. Online Orders

Details of Online Order transactions.

- Online Orders: Includes quantity of online orders and total amount.

- Online Tip: Includes quantity of online order tips and total amount.

- Total Online: Combined total of online orders and online tip amounts.

6. Voids

Details of transactions that were voided.

- Order Details: Includes order number, date and time, items voided, cashier, and approver.

- Total Voids: Combined total of all voided transactions.

7. Discounts & Comps

Details of discounts and comps applied to transactions.

- Order Details: Includes order number, date and time, type of discount or comp, amount, cashier, and approver.

- Total Discounts & Comps: Combined total of all discounts and comps.

8. Sales by Sales Category

A summary of total sales broken down by sales category.

- Sales Categories: Lists all sales categories with total quantities sold and amounts.

- Total Sales: Combined total of all sales categories.

9. Sales by Employee

Breakdown of sales by each employee.

- Employee Names: Lists employees with the number of transactions they handled and total sales amount.

- Total Sales: Combined total of all employee sales.

10. Sales by Order Type

Summary of sales by order type (e.g., dine-in, take-out).

- Order Types: Lists order types with total amounts.

- Total Sales: Combined total of all order types.

11. Sales by Register

Breakdown of sales by each register.

- Register Names: Lists registers with the number of transactions and total sales amount.

- Total Sales: Combined total of all register sales.

12. Sales by Zone

Summary of sales by different zones within the establishment.

- Zone Names: Lists zones (e.g., bar, dining room, outside) with total amounts.

- Total Sales: Combined total of all zones.

13. Cash by Employee

Details of cash transactions by each employee.

- Cash Sales: Total cash sales handled by employee.

- Gift Card Cash Sales: Total gift card cash sales by employee.

- Card Tips: Total card tips.

- Service Charge: Total service charge tips.

- Owe to Merchant: The balance each employee owes or is owed by the merchant.

- (Owe to Merchant) = Restaurant owes employee.

- Owe to Merchant = Employee owes restaurant.

14. Cash in Drawer

Summary of cash in the drawers, organized by each register.

- Cash In: Total cash in amount for the register.

- Cash Out: Total cash out amount for the register.

- Total Cash In-Out: Net total of cash in-out (Cash In - Cash Out).

- Total Cash Payments: Total amount of cash payments received.

- Gift Card Redemption: Total amount redeemed through gift cards.

- Total Register: Overall cash amount in the register.

By understanding each section of the Close Cash receipt, you can ensure accurate daily transaction recording, maintain financial stability, and optimize the POS system performance.

Suggested Articles:

Close Cash Process Guide

Close Cash Settings

Auto Close Cash