Table of Contents

- Taxes Report Introduction

- Key Metrics and Definitions

- Data Table

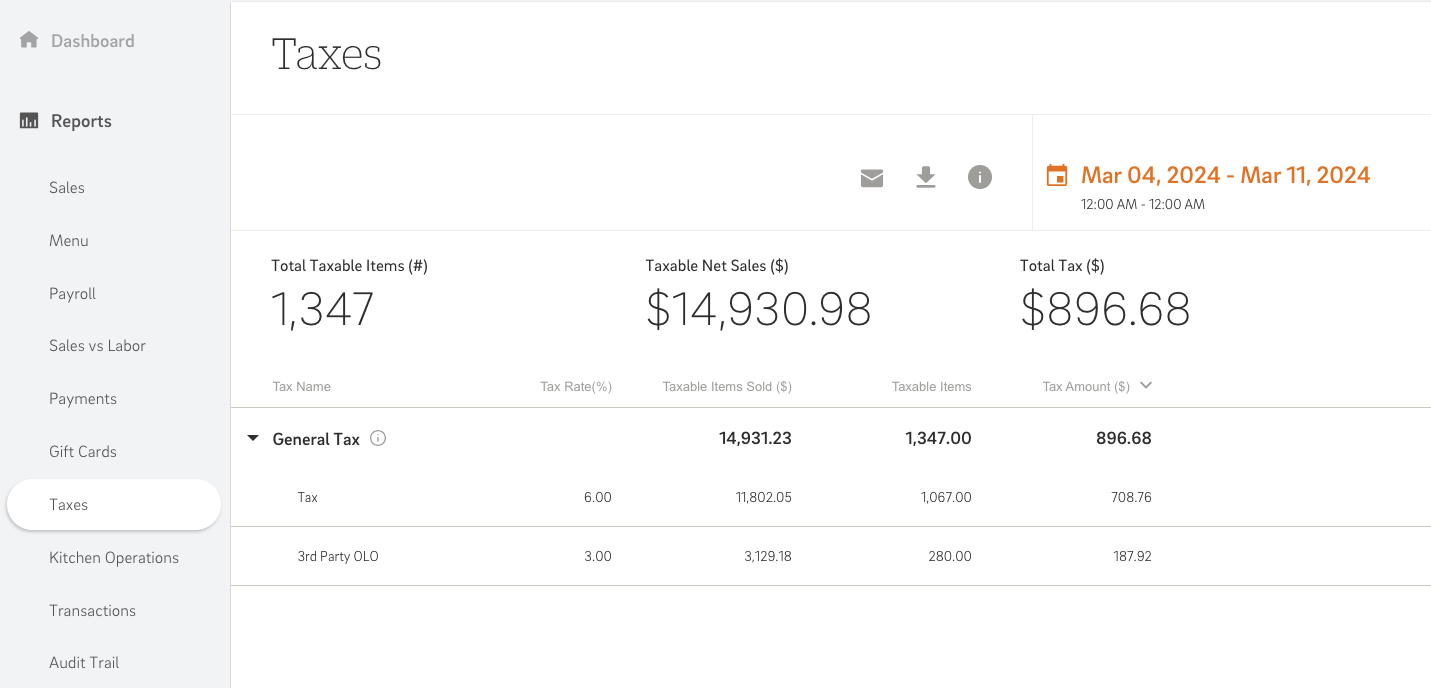

The CAKE Dashboard provides a comprehensive overview of various tax types, including their respective rates, the number of taxable items, taxable item sales, and the amount of tax paid for the set date range. This report encompasses taxes generated from both in-store and online orders, offering valuable insights into tax-related transactions.

Let's explore the key metrics included in the Taxes Report Summary:

-

Total Taxable Items (#): The total count of taxable items sold, including items with 0% tax and tax-exempt items.

-

Taxable Items Sold ($): This figure represents the total sales revenue generated from taxable items, including items with 0% tax and tax-exempt items.

-

Total Tax ($): This column aggregates the tax amounts listed in the data table, including service charges. In cases where an item incurs multiple taxes, the tax value is considered only once. Notably, the service charge tax is considered solely for the Total Tax calculation.

The data table provides a detailed breakdown of tax-related information:

-

Tax Name: Identifies the name of each tax type applied.

-

Tax Rate (%): Specifies the tax rate associated with each tax type.

-

Taxable Items Sold ($): Indicates the total sales revenue generated from taxable items subject to the respective tax.

-

Taxable Items: Provides insight into the amount of items considered taxable under each tax type.

-

Tax Amount ($): Represents the total amount of tax paid for each tax type within the specified time period.

The Taxes report offers a comprehensive platform for tracking and analyzing tax-related data, enabling businesses to optimize their tax strategies and ensure regulatory compliance.

Learn how to set up tax rates via the v3 Menu Admin: Taxes article.

Learn how to automate the sales tax process with the CAKE x DAVO Integration.

Mastering CAKE Reports